Guide to economics modelling assignments

Info: 4136 words (17 pages) Study Guides

Published: 03 Sep 2025

Need expert economics assignment help? Get personalised guidance on economic modelling, empirical strategies, or any economics assignment from a UK-qualified economics specialist with our economics assignment help service.

Economic modelling assignments are a core part of economics education, requiring students to create, manipulate, and interpret models to analyse economic problems. These assignments involve developing theoretical or empirical models to test hypotheses and predict outcomes, and they demand both analytical rigour and clarity of explanation.

An economic model is essentially a simplified representation of reality designed to yield testable hypotheses about economic behaviour (Ouliaris, 2011a). In practice, this means abstracting from real-world complexities to focus on key variables and relationships. Such models allow economists to explore how changes in one aspect of the economy might affect others under controlled assumptions.

Understanding the task and its objectives

Before looking at equations or data, it is crucial to understand the assignment’s requirements. Determine whether the task is primarily theoretical, empirical, or a combination of both.

In broad terms, theoretical models provide qualitative insights by deriving implications from assumptions. Empirical models use real data to test those implications and assign them numerical magnitudes (Ouliaris, 2011a).

For example, a theoretical consumption model might predict that higher income leads to higher spending. An empirical model could then estimate how much expenditure increases when income rises (Ouliaris, 2011a).

Clarifying the objectives early on will guide your approach. Is the goal to derive a new theoretical result, to test an economic hypothesis with data, or to forecast future outcomes? Understanding this shapes everything from model design to the form of your results.

At undergraduate level, assignments often ask you to apply or extend established models to demonstrate understanding. At postgraduate level, there is greater emphasis on originality. You might be expected to modify a standard model or employ more advanced techniques. In all cases, success depends on how well you justify your modelling choices, carry out the analysis, and interpret the findings in light of the economic question.

Theoretical economic modelling assignments

Writing a clear theoretical framework

In a theoretical modelling assignment, you are typically asked to formulate a model that captures the essence of an economic problem. This involves specifying the economic agents, their objectives and constraints, and the key variables and parameters of interest.

Begin by reviewing relevant economic theory and models from the literature to ground your work in established frameworks. Showing familiarity with existing models and results will demonstrate context for your approach.

Defining model assumptions

Next, clearly state the assumptions of your model. Every model is a deliberate simplification of reality. Economists abstract from certain details to focus on the most important mechanisms.

Define all variables and parameters, and use consistent notation. Justify each key assumption by explaining why it is made and how it influences the model’s relevance. For instance, you might assume a perfectly competitive market or no externalities – these conditions simplify the analysis but also limit real-world applicability. If an assumption is particularly strong (like perfect rationality or no externalities), acknowledge it. You can also discuss later how relaxing that assumption might change the results.

When constructing the model, start simple. Renowned economist Hal Varian advises modellers to “write down the simplest possible model” that captures the core phenomenon. Only then should you consider adding complexity (Varian, 1997). Following this principle prevents you from getting lost in algebraic complications that do not give any additional insight.

A basic, well-understood model can always be enriched if needed. An overly complex model, by contrast, may obscure the economic intuition. Aim to capture the fundamental mechanism with as few moving parts as possible. For example, if you are analysing a market, you might begin with a basic supply-and-demand framework. Only then would you add layers like imperfect information or additional constraints. Throughout the modelling process, maintain a clear line of reasoning that connects your setup to the question at hand.

Analysing the model and deriving results

Once the theoretical framework is set, proceed to solve or analyse the model. In many cases, this means deriving equilibrium conditions, solving optimisation problems, or performing comparative statics. Work through the mathematics step by step, but keep the economic intuition in view.

For instance, if your model involves consumers maximising utility subject to a budget, derive their demand functions and then interpret those functions: what does an increase in income do to demand, and why?

Each mathematical result (a solution or a first-order condition) should be accompanied by an explanation in plain English. This demonstrates that you understand not just how to do the math, but what the math implies about real economic behaviour.

If the assignment expects it, conduct comparative statics – examine how changes in a parameter affect the model’s outcome. Comparative static exercises are useful for demonstrating your ability to manipulate the model. They allow you to extract meaningful predictions (e.g., “if X increases, the model predicts Y will decrease, ceteris paribus”).

Ensure you articulate these cause-and-effect relationships clearly, using transitional words to highlight logical consequences. For example: “therefore”, “as a result”. You might say, “when the tax rate increases, the model shows output falls because higher taxes discourage production.” By explaining the chain of logic (higher tax → higher cost → lower supply → lower output), you make it easy for the reader to follow your reasoning.

Discussing implications and limitations

It is also important to discuss the implications and limitations of your theoretical findings. What does the model suggest about the original economic question or hypothesis? Does it provide a plausible explanation or prediction?

At the same time, be candid about the model’s assumptions and how they might limit the applicability of your results. Every theoretical model is a stylisation of reality, so its predictions must be qualified by the simplicity of its structure. A high-scoring assignment will include a reflection on whether the model’s predictions are realistic and consistent with empirical observations.

For example, if your model predicts an extreme outcome under certain conditions, note whether such an outcome is actually observed in real economies or if it arises from the model’s restrictive assumptions. Discussing such points shows a critical engagement with your work.

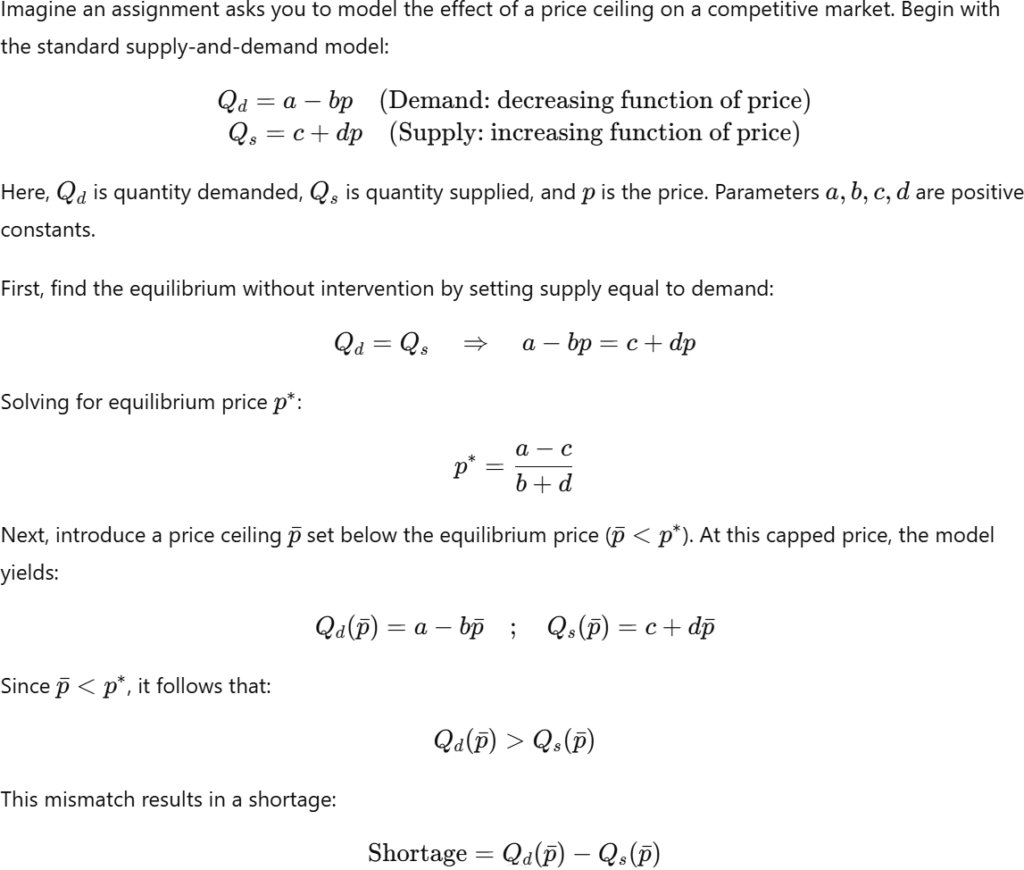

Example: Theoretical model

You would explain this result in words:

“Because the imposed price is below the market-clearing level, consumers want to buy more than producers are willing to supply, creating a shortage.”

You can then discuss implications, such as welfare loss (due to lost mutually beneficial trades), potential black markets, or quality degradation – factors not captured in the simple model.

Finally, acknowledge limitations: the model assumes a perfectly competitive market without product differentiation or enforcement issues, factors that could either mitigate or exacerbate the theoretical outcome.

By clearly walking through this example, you show how to set up a theoretical model, derive results, and interpret them critically.

Empirical economic modelling assignments

Designing an empirical strategy

Empirical modelling assignments involve using data to test economic hypotheses or to forecast outcomes. The first step is to articulate a clear hypothesis or question that your empirical model will address. Typically, the hypothesis comes from economic theory or from a policy issue.

For example, you might hypothesise that higher education levels increase individuals’ earnings or expansionary monetary policy lowers unemployment in the short run. Starting with a well-defined hypothesis helps guide the choice of data and econometric techniques. As with theoretical work, connecting your hypothesis to existing literature is valuable. It shows you understand where the question comes from and how others have approached it.

Data collection and preparation

After setting the hypothesis, the next key task is identifying and gathering suitable data. Consider what data would allow you to test the hypothesis. In the education example, you would need data on individuals’ earnings and education levels. You would also include other control variables (such as work experience and age) to account for confounding factors. Describe the data clearly: what is the sample (e.g., 10,000 UK workers in 2020), what variables are available, and how they were measured.

If data is provided by the instructor, you should still describe it. For example, you might write: “This analysis uses cross-sectional data on 10,000 UK workers in 2020, including their annual income, years of schooling, age, and occupation.” Discuss any data limitations or quirks. Are there missing values or outliers? Is the sample representative? Noting such considerations indicates a rigorous empirical mindset.

Model specification and identification

With hypothesis and data in hand, choose an appropriate empirical model and methodology. In economics, the most common empirical tool is regression analysis, especially the linear multiple regression model (Ouliaris, 2011b; Wooldridge, 2019).

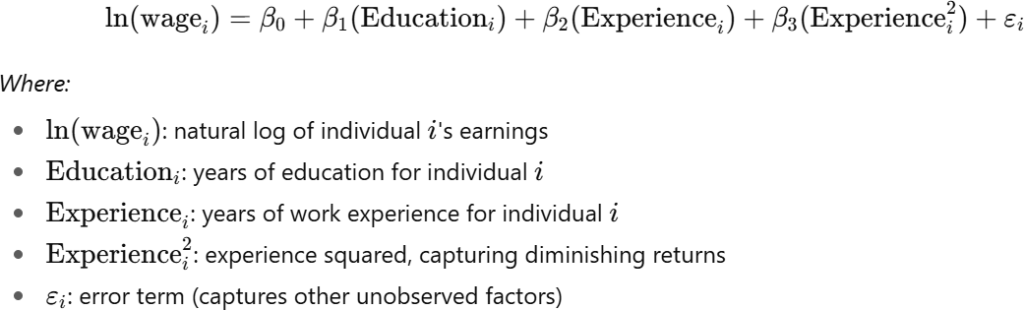

The goal is to quantify relationships between variables while holding other factors constant. For the education example, you might specify a linear regression where log earnings is the dependent variable and years of education is a key explanatory variable. Other controls would also be included (e.g., experience and age).

Clearly write out the model specification. For instance:

Explain why you chose this functional form and variables. Economic theory can guide these choices. For example, human capital theory suggests including experience and its square (because earnings rise with experience but at a diminishing rate).

One crucial aspect at this stage is ensuring identification and addressing potential biases. Ask yourself: if I observe a correlation between education and earnings, does it truly reflect a causal effect? It might not if there are omitted variables (like innate ability) or reverse causality (higher earners might pursue more education).

In an undergraduate assignment, acknowledging such issues may be sufficient. In a postgraduate assignment, you might be expected to propose a remedy, such as using an instrumental variable or a difference-in-differences approach to pin down causality.

The sophistication of the empirical strategy should match the level of study. For example, undergraduate projects might focus on getting the basics right – proper specification, checking assumptions, interpreting coefficients – while postgraduate work can involve more complex techniques to tackle endogeneity or to model dynamic relationships.

Always justify the techniques you use, and make sure you can explain them. It is better to use a simpler method you understand well than a complex method you cannot adequately justify.

Estimation, testing, and interpretation

With the model specified and data ready, the next step is estimation. Use statistical software to estimate the parameters (coefficients) of your model. Although the computer does the calculation, you must interpret the output. Present the results in a clear table as needed, then focus on what they mean.

Interpreting key results

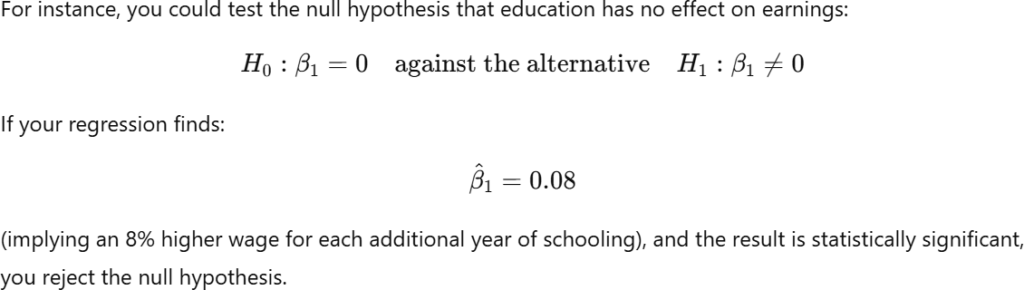

Start by explaining the core findings: Which coefficients are statistically significant, and do they have the signs you expected? For each key parameter, you can perform formal hypothesis tests.

Thus, the data suggests a positive effect of education on earnings.

It is essential to present this in clear, non-technical language. You might write:

“The coefficient on Education is 0.08, implying that an additional year of schooling is associated with approximately an 8% higher wage, holding other factors constant. Therefore, the results support the hypothesis that education improves earnings prospects.”

However, interpreting this as a causal effect requires assuming that no unobserved factors bias the estimate. Otherwise, the result may not reflect a true causal relationship.

In practice, you should use appropriate transition words to tie statistical results to their economic meaning (e.g. “therefore,” “however,” “in contrast”). This helps the reader follow your interpretation. Always be careful to distinguish economic significance from statistical significance. A coefficient might be statistically different from zero yet economically small. Discuss whether the size of the estimated effect is meaningful in practical terms.

A high-quality empirical analysis will also check the validity of the model and robustness of results. Does the regression meet the assumptions required for trustworthy inference? This involves examining residual diagnostics and considering potential issues.

For example, check whether the residuals show any problematic patterns (which could indicate a mis-specified functional form or heteroscedasticity). If you detect issues like heteroscedasticity, you might use robust standard errors or a different model specification. You should also assess whether including or excluding certain variables changes the key results.

Often, you will perform robustness checks, such as trying alternative specifications or subsamples. Consistent results across such checks add credibility.

Furthermore, consider economic significance alongside statistical metrics. For instance, an R-squared value might tell you the model’s overall fit, but more important is whether the relationships make economic sense. Do the signs of key coefficients align with theory? (If a model predicted a decline in consumption when income rises, it would fail the “smell test” of economic logic.) If some estimated coefficients do not make sense, you should contemplate why. It could signal omitted variables, measurement error, or other issues. Demonstrating this level of critical thinking will set your work apart.

Example: Empirical model

Suppose your assignment is to evaluate whether a job training program increases participants’ wages. Your hypothesis is that attending the training causes an uplift in earnings. You obtain longitudinal data on individuals before and after the program, including a group that participated (the treatment group) and a similar group that did not (the control group).

To tackle this, you decide on a difference-in-differences approach: you will compare the change in wages for the treated group to the change for the control group over the same period. This method helps control for any common trends affecting both groups.

After setting up the data, you run a regression of wage change on a dummy variable for program participation (among other controls). The coefficient on the participation dummy comes out to approximately +£500 and is statistically significant. You interpret this as evidence that the training program led to an average £500 increase in annual earnings for participants. This effect is measured relative to non-participants, ceteris paribus.

Furthermore, you check robustness by adding controls for each person’s initial wage level (to account for regression to the mean) and by looking at whether the two groups had parallel wage trends before the program. The effect remains around £500, which increases your confidence in the result.

Finally, you acknowledge potential limitations. For example, those who chose to join the program might have been more motivated or skilled to begin with, which could bias the estimate (a classic selection bias concern).

You explain that while the difference-in-differences design helps, it may not fully purge all bias if unobserved differences remain. By following this process, you show how to go from an economic question to an empirical answer. It demonstrates that you have carefully justified each step and considered what the results mean.

Presenting and discussing model findings

No matter how elegant your analysis, the clarity of presentation will heavily influence the impact of your assignment. Organise your report or essay with a logical structure (introduction, methodology, results, discussion, conclusion) so the reader can easily follow the progression of your work. Write in a formal academic style, but strive for concise and active sentences. When writing about models, it is common to mix mathematical expressions with narrative.

Writing with clear structure and style

Organise your writing in well-structured paragraphs and use headings and subheadings to signpost sections. Introduce the purpose of each section clearly. For instance, the results section should begin by stating what is being examined (“This section presents the regression results and evaluates the hypothesis.”).

Use transition words to ensure a smooth flow of ideas (words like however, furthermore, thus). Write in the active voice whenever possible. For example, instead of writing “it was found that the model failed to converge,” say “the model failed to converge”.

Active voice makes your writing more direct and vigorous. Additionally, use positive phrasing and avoid unnecessary negatives. Compare “the model is not inaccurate” with “the model is accurate” – the latter is much clearer.

Throughout your writing, maintain a formal tone and avoid colloquialisms, but it is perfectly fine to write in the first person plural (“we”) or an impersonal style (“this analysis”) depending on the conventions you have been taught. The key is to be clear and precise.

Using tables, graphs and equations effectively

Tables, graphs, and other figures can be extremely helpful in an economic modelling assignment. They often convey information more effectively than words alone. All figures and tables should be neatly presented and clearly numbered (e.g., “Table 1: Regression Results”). Ensure each has a descriptive caption.

In the text, refer to them and summarise their message. For example: “Table 1 shows the estimated coefficients for the consumption model. As we can see, income has a positive and significant effect on consumption, whereas the interest rate has a negative effect, as expected.” By doing this, you never force the reader to interpret data on their own – you guide them.

If you include a graph of actual versus predicted GDP from your model, be sure to describe what it shows and why it matters. Figure 1 indicates that the model tracks the 2020 recession quite closely, though it slightly underestimates the recovery in 2021. That kind of sentence tells the reader the takeaway from the graph.

Every figure or table should serve a purpose in supporting your argument. Never include raw output or a graph without explanation, hoping the reader will infer the point – always state the point explicitly.

Discussing results and concluding

After presenting your model results, you should interpret and discuss them in a broader context. In the discussion section, compare your findings with expectations from theory or with results from other studies.

For instance, if your empirical finding that education has roughly an 8% return per year of schooling is consistent with the literature on returns to education, mention that. “This estimate is in line with typical Mincerian earnings regressions, which often find returns to schooling around 5–10% (e.g., Smith, 2019).”

If, on the other hand, you find a result that contradicts standard theory, discuss possible reasons. Perhaps the data cover an unusual period, or perhaps the model omitted an important variable. Showing awareness of alternative explanations or limitations will earn you credit for critical thinking.

Every assignment should end with a strong conclusion. Sum up the main insights of your modelling exercise and reflect on what has been learned. Avoid simply restating results; instead, synthesise them.

For example:

“In summary, the theoretical model suggests that raising tariffs can improve a large country’s terms of trade, but at the cost of global efficiency. Our empirical analysis of UK trade data generally supports this finding, although the effect size was modest.”

In addition, acknowledge the limitations of your work and suggest future research or next steps. No analysis is perfect, especially not within the constraints of a student assignment. Perhaps the theoretical model could be extended to include another factor, or perhaps additional data or more sophisticated econometric techniques could improve the empirical analysis.

By openly discussing such limitations, you show humility and an understanding that models are only approximations. This will strengthen the credibility of your conclusions rather than weaken them. Finally, ensure your conclusion ties back to the original question posed in the introduction, giving the reader a sense of closure that the assignment’s objectives were met.

Common pitfalls and how to avoid them

When completing economic modelling assignments, students frequently encounter a number of common pitfalls. Being mindful of these can significantly improve the quality of your work:

Technical and analytical pitfalls

Overcomplicating the model:

It can be tempting to pack in additional equations, variables, or advanced techniques to impress the reader. But unnecessary complexity often backfires. It is usually better to have a simpler model that is clearly explained and correctly solved than a highly complex model that you do not fully understand. Keep the focus on the economic question. As noted earlier, keeping models as straightforward as possible while still capturing the key mechanism is a sound strategy (Varian, 1997).

Insufficient attention to assumptions and conditions:

Every model, theoretical or empirical, rests on assumptions. A common mistake is to take these for granted and not state or examine them. Always explicitly state important assumptions (e.g. “assuming no externalities” or “assuming the error term is not autocorrelated”) and consider whether they hold in your scenario. If an assumption might be questionable, acknowledge it and discuss how it might affect results. This shows your awareness of the model’s scope.

Ignoring model diagnostics and accuracy:

In empirical modelling, students sometimes report results without checking if the model is well-specified. This includes ignoring diagnostic tests (for example, checks for heteroscedasticity or multicollinearity, or whether an instrumental variable truly satisfies its assumptions). Likewise, for theoretical models, one might claim a result without considering edge cases or whether the solution makes economic sense (for instance, a “corner solution” where consumption becomes negative). Always perform sanity checks on your models. If something looks odd (a counterintuitive sign or an implausibly large coefficient, or a violation of a constraint like a probability exceeding 1), investigate and comment on it. It could indicate that your model needs refinement.

Communication and presentation pitfalls

Neglecting the economic interpretation:

A model’s equations or statistical outputs are not very useful unless you interpret them. Avoid writing pages of derivations or regression tables with minimal commentary. Always tie the results back to the economic intuition or real-world implications.

For example, don’t just state:

Explain what that means (perhaps “implying an 8% wage increase per year of education, evidence of substantial returns to schooling”). Remember that the goal is to learn something about the economy, not just to manipulate symbols or numbers.

Poor linkage between theory and empirics:

Many assignments expect you to connect a theoretical framework with empirical evidence. One pitfall is treating the theory and the empirics as completely separate silos. Instead, use theory to motivate your empirical specification (for instance, theory might suggest including a quadratic term or an interaction of certain variables).

Conversely, use empirical findings to reflect back on the theory: did the theoretical predictions hold up? If not, why might that be – does the theory miss something, or is there an issue with the data? Showing the interplay between model and data demonstrates a deeper understanding.

Weak structure or presentation:

Even if your analysis is sound, poor organisation and writing can undermine its impact. Common issues include jumbled structure, lack of signposting, overly long paragraphs, and grammatical errors. To avoid this, take time to outline your assignment before writing. Ensure each section has a clear purpose.

Write in short, readable paragraphs (3–5 sentences is a good average). Use subheadings to break up sections that are getting long or complex. Also, be consistent in notation and terminology throughout the paper.

Finally, leave time to proofread carefully. Check that your graphs and tables are properly labeled and referenced in the text, and that your citations and references are in order. A well-presented assignment not only looks professional but also makes it easier for the grader to follow your arguments – which can only help your mark.

Wrapping up:

Economic modelling assignments, whether theoretical or empirical, are exercises in bringing economic ideas to life through formal analysis. By carefully constructing a simplified representation of an economic scenario, you can investigate how and why certain outcomes occur.

The key to excelling in these assignments is to remain focused on the economic question. Ensure that every part of your model and analysis contributes to answering that question. Theoretical models require clarity of assumptions and logical consistency, providing insight into mechanisms, while empirical models demand careful data handling and statistical rigour to test hypotheses. Both benefit from a clear connection to economic theory and a thoughtful interpretation of results.

In approaching such tasks, start with a strong plan: understand the problem, outline the steps (model setup, solution or estimation, interpretation), and allocate time wisely for each. Be prepared to iterate – you might need to refine your model or redo an estimation if initial results are puzzling. This iterative process is normal in economic research (indeed, it is how professional economists develop their models). Furthermore, writing up the assignment is not an afterthought; it is an integral part of the exercise. Your ability to communicate your methods and findings persuasively is as important as the analysis itself.

By adhering to principles of sound economic reasoning, rigorous analysis, and clear exposition, you will produce work that meets the assignment criteria. Economic modelling is a challenging endeavour, but it is also immensely rewarding. It allows you to formally explore “what if” scenarios and to confront theories with evidence.

Need expert economics assignment help? Get personalised guidance on economic modelling, empirical strategies, or any economics assignment from a UK-qualified economics specialist with our economics assignment help service.

References and further reading:

- Ouliaris, S. (2011a). What Are Economic Models? Finance & Development, 48(2), 46–47.

- Ouliaris, S. (2011b). What is Econometrics? Taking a theory and quantifying it. Finance & Development, 48(4), 38–39.

- Varian, H. R. (1997). How to Build an Economic Model in Your Spare Time. Unpublished essay, University of California, Berkeley.

- Wooldridge, J. M. (2019). Introductory Econometrics: A Modern Approach (7th ed.). Cengage Learning

Cite This Work

To export a reference to this article please select a referencing stye below: